YOU NEED A LOAN FAST, RIGHT?

You probably have lots of questions. Are loan sharks real? Are loan sharks as bad as Hollywood makes them out to be?

The answer is YES and YES

- A loan shark is a person who lends money & charges incredibly high interest rates

- A loan shark is a criminal who lends money illegally

- A loan shark will use violence to collect and is very dangerous

- A loan shark offer no documentation, making it difficult to prove what you’ve paid.

Stay away from loan sharks. Here are better bad credit loan option

And The Shark Circles

Loan sharks are predators. They prey on the desperate, the financially needy and the naive. People turning to loan sharks for bad credit loans have used up all of their savings, borrowed until family and friends turn them down and often don’t have the credit history to borrow from traditional banks.

6 Ways We Can Help You

For emergency loans,

medical loans and

so much more!

Need a new ride?

We’re here to help

find the car you want!

Need a business loan?

We understand though

credit situations.

Trouble buying a house?

Get started buying your

dream home today!

Not all student loans are equal.

Pick the best and cheapest

student loan right here!

Drowning in a sea of debt?

Need a lifeline right now?

Apply to consolidate today!

Latest From the Blog

Specific Loans To Meet Your Needs

When You Need A Bad Credit Personal Loan

When you’re looking to take out a personal loan, you’ll find that the rates are quite a bit higher than those of home loans or car loans. This is because, unlike car or home loans, there is no property attached to the loan to help make it secure. When taking out a...

read moreSmall Business Loans vs Payday Loans

Why Small Businesses Are Falling for Loan Sharks You hardly sleep when you run a business. Even after you build your business, there are there is a constant need for financing. You have to pay for the equipment and furnishings. You may need to renovate your office...

read moreA Loan Sharks Definition: Lender vs. Shark

Signs to Tell the Lenders from the Loan Sharks Loan sharks go by many names. They are often called predatory lenders or underground bunkers. A loan sharks definition has changed little over the decades. All charge very high interest rates and fees. While loan sharks...

read more5 Reasons To Get A Bad Credit Home Equity Loan

5 Reasons To Get A Bad Credit Home Equity Loan Having bad credit is not the end of the world. There I said it. You can get a loan and you can avoid loan sharking. Now, let's be honest, bad credit does make getting a home loan more difficult.There are lenders who will...

read moreStill Need A Loan Shark?

So you need money now and you need it badly. Loan sharks are real and they are really bad.We understand the need for money. We’ve all been there. But loan sharks are not the way to go. There are loans for people will all types of credit. Legal loans, regulated by the government. These are better bad credit loan options. Here’s why.

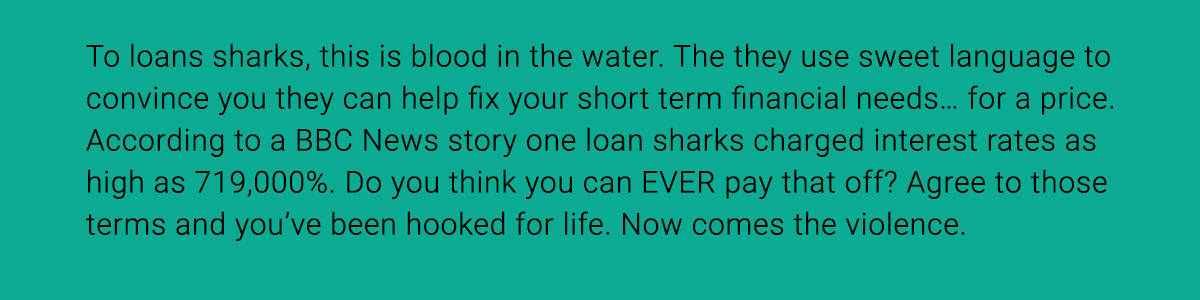

Loan Sharks Charge Outrageous Interest Rates!

You’re thinking, “I need a loan shark”. And you believe you’ll be able to pay the money back. That might be true with a legal loan with high, but regulated interest rates. Loans sharks charge rate in the thousands. In fact, APR’s of 8,000% to 12,000% are not uncommon. This is in contrast to credit cards charging high risk customers 28.99% APRs. These incredible loan shark interest rates make paying off the loan hard, if not impossible. A small loan will take many years to pay off, draining you of your money and making a criminal rich.

A History Of Violence

Loan sharks will give you money ASAP, but it comes at a high price. If you continue to pay off the loan, things might be fine. But if you miss a payment, illegal lenders may turn to violence to recovery their money.

Here is a pretty common example:

“Julie, whose name has been changed to protect her identity, used a loan shark after losing her job. She borrowed £300 and had to repay £680. She made the first four payments, but missed the next two. The loan shark immediately demanded an extra £300.

‘I told him it wasn’t fair,’ the woman in her 20s says. ‘But he just said he didn’t care and that I had to pay him.’

Julie managed to scrape together £700 from family and friends. She gave it to the loan shark, hoping that would be the end of the loan.But he demanded more. When she refused, he ordered her to hand over her gold jewelry. When this was not forthcoming, he attacked her.

‘He grabbed me round the throat and then lifted me off the sofa until I was eye to eye with him,’ she says. ‘I didn’t know what he was going to do. He was squeezing harder and harder.’

Only when a friend who was in the room called the police did he release Julie, throwing her against a wall and breaking a rib. The police became involved, but the threats continued until Julie moved house. But the loan shark has not forgotten her.

‘He told my friends it may be five years, it may be ten or 15, but he will find me and scar me for life,’” she told London’s Dailymail.“

According to the US Attorney’s Office in Philadelphia a violent gang threatened their customers with guns and hatchets, telling victims they would kill them or hurt their family members.

With intimation and threats violence and sexual violence, some customers have committed suicide.

No Rules, No Options

Since loan sharks are not regulated, they make up their own rules. And who do you think this rules are redesigned to benefit? If you find a loan sharks, you’ve put yourself at that criminals mercy. They can change the interest rates or payment terms whenever they want. If they don’t count a payment or there is a dispute, you have no options. You can certain go to the police but that may bring violence and intimidation. Your best bet is to avoid loan sharks completely.

Legal Loan Options

Hopefully, we have steered you away from loan sharks and towards other sources of cash. Let’s breakdown what some of your choices are.

Bad Credit Car Loans

Even with bad credit you can get a car loan. Yes, it will be more expensive and a little more difficult to secure, but you can do it. Yo may not be able to buy the newest car, and perhaps, that’s a good thing. Longterm getting back on your financial feet is the wise move.

But if you really need a car now, here who you should expect:

- Higher Interest Rate.You’re not going to get ht e incredible interest rates you see on the TV commercials. Nope. Not going to happen. No Zero down. Zero APR. You’ll look for interest rates as high as 20%+.

- Larger Down Payment. You’re viewed as more risky, so you’ll have to put more money down. The more money you have to put down, the better position you are in.

- Reduced Choices. The top end luxury car may be out of reach. If your credit is really spotty you may have to try a Buy-Here, Pay-Here used car dealer. These dealers may want weekly or biweekly payment, but could offer you a car loan with other won’t. Some also report your positive payment history to the national credit bureaus which coulee help you build your credit score.

Ultimately, bad credit auto loans depend a lot on the dealership or car lot and the banks or financing companies they use. If you want to go to a big bank, they may finance you but on the same higher terms as used car finance companies.

Unsecured Bad Credit Loans

Now these can be tough to get. The bank has to trust that you will pay them back and your credit history says you’ve had a rocky time in the

past. Don’t give up home. Payday loans are a safe and legal way to get short-term emergency funds. But the key is short-term.

No doubt there is a payday loan shop near you. There are some online too. Payday loans come without credit check and many offer fast approval. The fees can be high and are meant to be paid back quickly. Payday loans are considered stop gap funding. It’s right in the name. It is meant to get you to payday. The average length of these loans is one to two weeks.

Bad Credit Personal Loans

Personal loans have some of the most flexibility. Need money for your wedding? Need to pay off credit cards? Need to handle an unexpected expense? Maybe even a vacation? Personal loans can be used to finance all these and more. Because the loans are unsecured the lending requirement are a little tougher. But if you can prove you have steady income this option may work. Peer to peer lending has stepped in to fill a void left by banks. They lend money to a wider range of customers. Also consider having a cosigner on a loan. This will make the bank feel a little better about making the loan and may reduce your interest rate too!

Bad Credit Home Loans

Here’s the good news. There are more programs than ever to help would be home owners become actual home owners. From FHA 3 percent down loans, VA loans to bank portfolio loans, even with poor credit it is possible to buy a home. If you have very little money to put down, government programs allow you to put 3 percent down and accept gifts to help cover closing and other costs. The process of getting and closing these loans can be a little slower, but it is worth of effort if you want to buy a house. But will most likely be asked to pay a higher interest rate loan. Again, finding a willing cosigner with a strong credit history and low debt to income ratio is always an option.

Debt Consolidation Loans

One of the first step in taking control of your finances is to consolidate your debt? This is where a debt consolidation loan come in. Debt

consolidation loans are a type of unsecured loans. Getting one does bring your credit into play again, but don’t let that discourage you. Check with your current bank or credit union to see what rates they are offering. If you are struggling with debt, these loans can help. Consolidating your debt into one monthly payment take some of the work out of managing multiple payments and may come at a lower interest rate. Now that can really save you money.

Bad Credit Student Loans

These loans are the easiest of all to qualify for with bad credit. Federal student loans are available to all students regardless of credit score or credit history. Direct student loans, back by the federal government are available who:

- Are US citizens •Enrolled at least half time at a qualified school

- With demonstrated financial need

- Submit a Free Application for Federal Student Aid form (FAFSA)

That’s it. Follow these steps and you’re going to get money for school. The interest rate will depend on whether your loans are subsidized or unsubsidized, but the rates are low and fixed.